Cryptocurrency Vs. Stock Market: Which Is Better? The Ultimate Guide

Cryptocurrency and the stock market are popular investment options. Both have unique benefits and risks.

When comparing cryptocurrency and the stock market, it’s essential to understand their differences. Cryptocurrency is digital money, traded online, and decentralized. The stock market involves buying shares of companies, and it’s regulated. Investors often wonder which is better for them.

Each option has its pros and cons. Your decision depends on your risk tolerance, investment goals, and understanding of each market. In this blog post, we’ll explore the key differences between cryptocurrency and the stock market. We’ll help you decide which might be a better fit for your investment strategy. Dive in to learn more about these two intriguing investment worlds.

Introduction To Investment Options

Investing can be an exciting journey. There are two main options: cryptocurrency and the stock market. Each has its own unique characteristics. Understanding them can help you make informed decisions. Let’s explore these investment options.

Emergence Of Cryptocurrency

Cryptocurrency is a digital form of money. It uses blockchain technology for security. Bitcoin was the first cryptocurrency, launched in 2009. Since then, many other cryptocurrencies have emerged. Ethereum, Ripple, and Litecoin are some examples. Cryptocurrencies offer a decentralized system. This means they are not controlled by any government or bank. This attracts many investors. They see it as a new and exciting opportunity. The value of cryptocurrencies can change quickly. This makes them a risky investment option.

Evolution Of The Stock Market

The stock market has a long history. It dates back to the 17th century. It allows people to buy shares of a company. When you buy a share, you own a part of that company. Stocks are traded on exchanges like the New York Stock Exchange. The stock market is regulated by government bodies. This provides a level of safety for investors. Over time, the stock market has grown and changed. New technologies have made trading easier. Many people invest in stocks for long-term gains. Unlike cryptocurrencies, the stock market is more stable. It offers a lower risk level for investors.

Credit: corporatefinanceinstitute.com

Risk Factors

Cryptocurrency and stock markets each carry unique risk factors. Cryptocurrency often faces high volatility, while stock markets may offer more stability but can be affected by economic changes. Understanding these risks is crucial for investors seeking the best option for their financial goals.

When deciding between cryptocurrency and the stock market, understanding risk factors is crucial. Both investment options have unique risks that can impact your financial decisions. Knowing these risks helps you make informed choices that align with your financial goals and risk tolerance.Volatility In Cryptocurrency

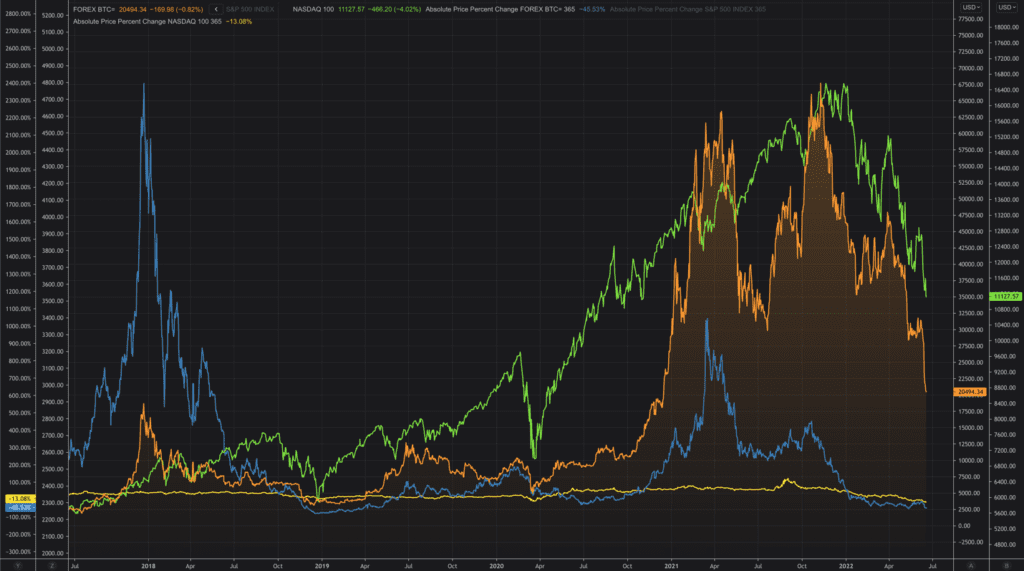

Cryptocurrency is known for its extreme volatility. Prices can skyrocket one day and plummet the next. This creates an exciting yet risky environment for investors. Consider Bitcoin, which once surged to over $60,000 before losing nearly half its value. Such fluctuations can be nerve-wracking. Are you ready to handle these rollercoaster rides? The decentralized nature of cryptocurrency adds to its unpredictability. Market sentiment, regulatory news, or even a tweet can cause massive swings. This can be thrilling for short-term traders but risky for long-term investors.Stock Market Fluctuations

The stock market also experiences fluctuations but tends to be more stable. Stocks are backed by tangible assets and earnings, which can provide a sense of security. However, they are not immune to downturns. Economic shifts, political events, and company performance can affect stock prices. During the 2008 financial crisis, many stocks lost significant value. This highlights the importance of diversification. On the upside, the stock market has a long track record of recovery. Historically, it has bounced back from crashes, offering potential for growth over time. Are you patient enough to weather these storms? In conclusion, both markets have distinct risk factors. Your choice should depend on your financial goals and risk appetite. Are you prepared to embrace the volatility of cryptocurrency, or do you prefer the steadiness of stocks?Potential Returns

Potential returns are a key factor when choosing between cryptocurrency and the stock market. Both offer unique opportunities to grow wealth. Understanding the potential gains can help in making an informed decision. Let’s dive into the specifics of each option.

Cryptocurrency Gains

Cryptocurrency has shown rapid growth in recent years. Bitcoin, for example, started at a few cents and reached thousands of dollars. This kind of growth is rare. Altcoins, like Ethereum and Ripple, also saw significant gains. Many investors have seen their investments multiply. But, the market is highly volatile. Prices can change drastically in a short time. This can lead to high returns. But also significant losses. Risk management is crucial.

Stock Market Profits

The stock market has a long history of providing steady returns. Blue-chip stocks, like Apple and Microsoft, offer regular growth. Dividends provide additional income. While the returns might seem slower, they are often more stable. The S&P 500 index has shown consistent growth over decades. This makes it a reliable choice for long-term investors. Diversifying your portfolio can reduce risk. Even during economic downturns, stocks can recover over time.

Accessibility And Regulation

Understanding accessibility and regulation is crucial in comparing cryptocurrency and stocks. Both markets offer unique opportunities and challenges for investors. Accessibility determines how easily investors can enter and trade. Regulation ensures safety and fairness in the market. These factors play a pivotal role in investment decisions. Let’s explore how each market fares in these aspects.

Ease Of Access To Crypto

Cryptocurrency offers unparalleled ease of access. Anyone with an internet connection can start trading. Setting up an account on a crypto exchange is straightforward. Most platforms require minimal personal information. This makes it attractive for many new investors. Transactions occur 24/7, providing flexibility and convenience. Users can trade at any time, day or night. Cryptocurrencies are also accessible globally. This allows people from different countries to participate easily.

Regulatory Framework In Stocks

The stock market operates within a well-defined regulatory framework. Government bodies like the SEC oversee and regulate stock markets. These regulations protect investors from fraud and malpractice. They ensure transparency and fairness in trading activities. Regulations also require companies to disclose financial information. This helps investors make informed decisions. The stock market’s regulatory environment offers stability and confidence. Investors know their rights are protected under the law. This level of regulation is not present in cryptocurrency markets.

Long-term Viability

The question of long-term viability is crucial when deciding between investing in cryptocurrency and the stock market. Both options have their unique benefits and risks, but which one holds more promise for the future? Understanding the trajectory of each can help you make a more informed decision and potentially secure your financial future.

Future Of Cryptocurrency

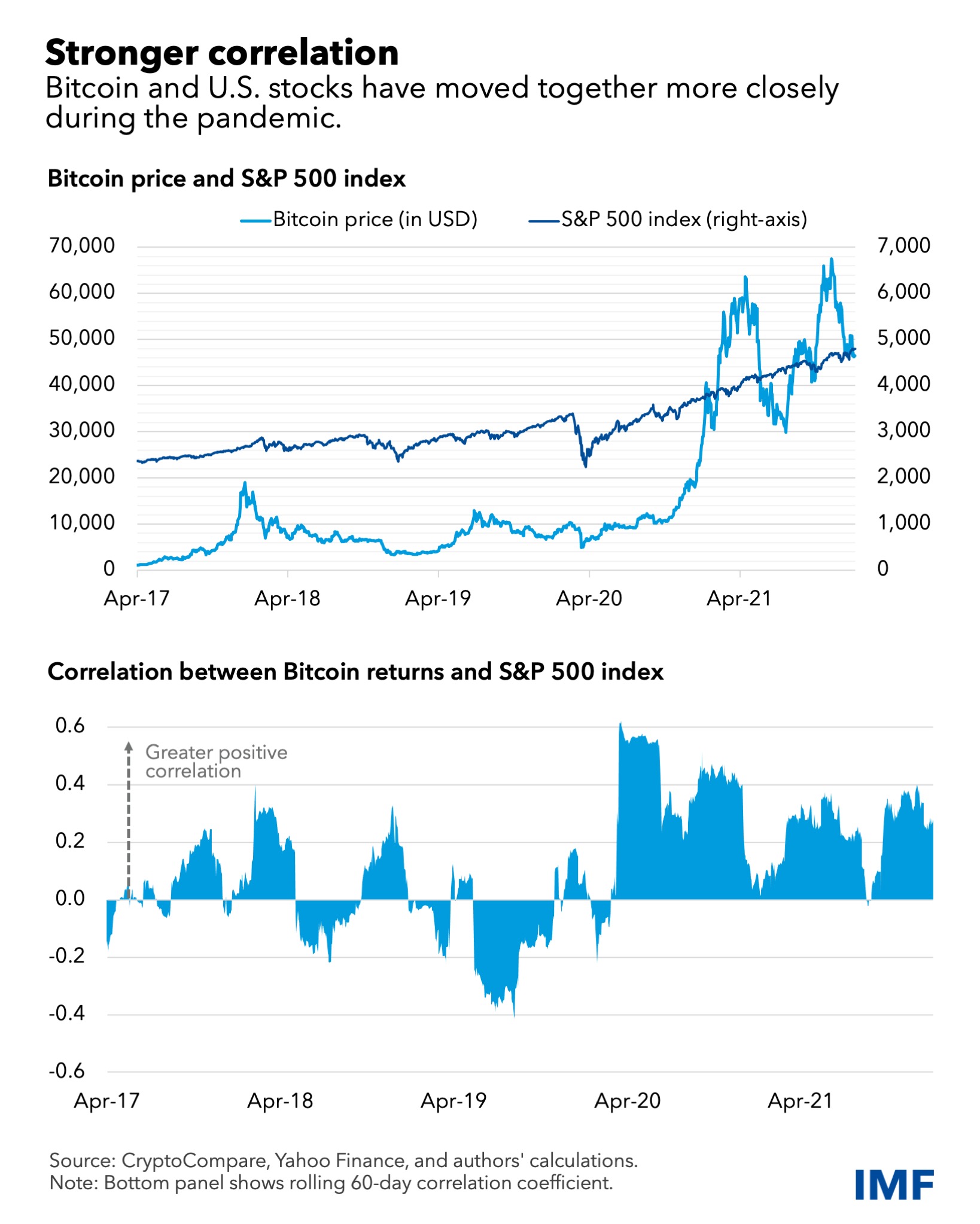

Cryptocurrency is still a relatively new player in the investment world. Its rapid rise and volatile nature have attracted both excitement and skepticism. While some see it as the future of finance, others worry about its unpredictable behavior.

Consider this: Bitcoin, once worth pennies, reached astronomical heights within a decade. Yet, its value can fluctuate wildly in a matter of days. This unpredictability makes it exciting, but also risky. Are you ready for such a rollercoaster ride?

Regulations could play a significant role in cryptocurrency’s future. Governments around the world are grappling with how to handle digital currencies. A favorable regulatory environment could enhance its credibility and stability. However, restrictive measures could dampen its growth.

On a personal note, I remember investing a small amount in Ethereum a few years ago. The initial thrill was palpable, but so was the anxiety of watching its value swing. If you’re comfortable with this level of uncertainty, cryptocurrency might be your pick.

Sustainability Of Stock Investments

Stocks have a long history and a track record of providing returns over time. They represent ownership in companies, some of which have been around for decades or even centuries. This history offers a sense of reliability and trust.

Historically, the stock market has shown resilience, bouncing back from crashes and downturns. Over the long term, it tends to grow, reflecting economic progress. However, it’s not without risks. Are you prepared for market corrections and economic downturns?

It’s worth noting that stocks can offer dividends, providing a steady income stream. This can be particularly appealing for those looking for regular returns. Unlike cryptocurrencies, stocks often come with a level of predictability that some investors find reassuring.

I recall my first stock purchase, a small tech company. Watching it grow over the years was a steady, rewarding experience. It taught me patience and the value of holding on through market fluctuations. If you value stability, stocks might be your preference.

So, which is better for the long term? The answer depends on your risk tolerance and investment goals. Both have potential, but they cater to different types of investors. What’s your take?

Credit: www.imf.org

Credit: remitano.com

Frequently Asked Questions

Is It Better To Invest In Crypto Or Stocks?

Choosing between crypto and stocks depends on your risk tolerance and investment goals. Stocks are generally more stable. Cryptocurrencies offer higher potential returns but come with greater volatility. Diversifying your portfolio by investing in both can balance risk and reward.

Always research before making any investment decisions.

Can You Make $1000 A Month With Crypto?

Earning $1000 monthly with crypto is possible but involves risk. Success depends on market conditions and strategies. Engage in trading, investing, or staking wisely. Research thoroughly and stay updated on trends. Always prioritize security and risk management.

Is Crypto Bigger Than The Stock Market?

The stock market is currently larger than the crypto market. As of now, the global stock market’s value is around $100 trillion, while the cryptocurrency market’s value is approximately $1 trillion. Both markets continue to evolve and grow, attracting diverse investors worldwide.

Is Crypto Still Worth Investing In?

Yes, crypto can still be worth investing in. Always research, understand the risks, and diversify your portfolio.

Which Crypto Will Boom In 2025?

Predicting specific crypto success in 2025 is uncertain. Research potential coins like Bitcoin, Ethereum, and emerging technologies for informed decisions. Stay updated with market trends and expert analyses to make educated investments. Diversification and caution are essential in the volatile crypto landscape.

Conclusion

Choosing between cryptocurrency and the stock market depends on your goals. Cryptocurrencies offer high risk but potential quick gains. Stocks provide more stability with steady growth over time. Consider your risk tolerance and financial objectives. Some prefer the excitement of crypto.

Others seek the reliability of stocks. Both have unique benefits and challenges. Educate yourself on each option. Make informed decisions. Diversify your investments for balance. This approach helps in minimizing risks and maximizing opportunities. Always research and stay updated. Investing wisely is key to financial success.